India’s average age today is just 28, but our life expectancy has climbed to almost 70 years in 2025. Think about that—just a century ago, people lived barely into their early 20s. By 1950 it rose to 33, then 52 in 1980, 61 in 2000, and now nearly 70.

It’s an incredible jump, thanks to better healthcare and improved living conditions.

Right now, senior citizens make up about 10% of our population, and this will rise to 20% by 2050. On the surface, that looks like progress.

But it also makes you pause and wonder:

Is this progress as smooth as it seems?

The government has introduced several schemes—Atal Pension Yojana, Atal Vayo Abhyuday Yojana, Rashtriya Vayoshri Yojana, and Ayushman Bharat–PMJAY—to support older adults, especially those with limited income. These programs offer pensions, basic assistance, and healthcare support.

But here’s the catch: only around 25% of India’s elderly actually receive any pension.

So most still depend heavily on family for everyday expenses.

And financial stress is only one part of the story.

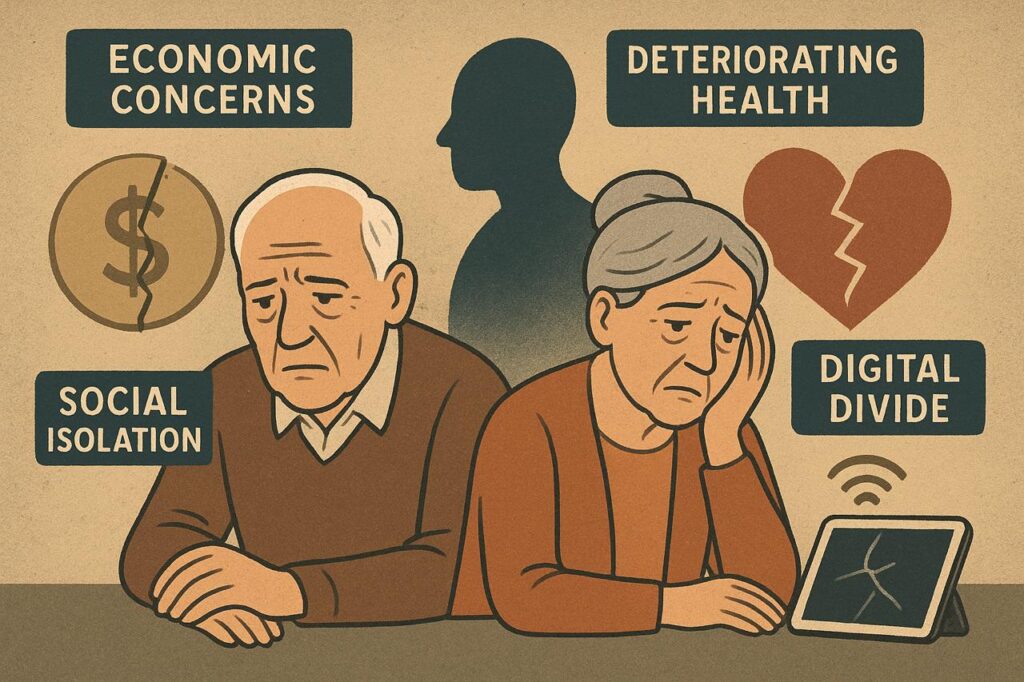

Challenges Faced by India’s Elderly

1. Social Isolation

According to WHO, around 14% of seniors above 70 experience anxiety or depression.

Urbanisation, busy work lives, and children moving away for jobs have made loneliness a very real challenge.

When one spouse passes away, the isolation becomes even more difficult to handle emotionally.

2. The Digital Divide

Technology is supposed to make life easier—but for many elderly people, it does the opposite.

Even TVs aren’t simple anymore; everything is “smart.”

Navigating smartphones, apps, online banking, or even just a remote can feel overwhelming.

This often leaves them dependent on others and frustrated.

3. Infrastructure Gaps

A small segment of society can afford modern, well-designed senior-living communities inspired by ideas like Ikigai, where everything is tailored for retirees.

But for most people in India, old-age homes still struggle with even basic standards.

Public infrastructure isn’t much better.

Footpaths, buses, trains—most aren’t designed keeping elderly mobility in mind.

Everyday tasks like climbing a bus step or crossing a road can become exhausting and unsafe.

4. Economic Pressures

Remember the movie Baghban?

As kids, most of us were angry at how the parents were treated.

But as adults, we realise today’s families deal with intense financial and emotional pressure.

Even dual-income households find it hard to afford housing, manage EMIs, raise children, support ageing parents, maintain careers, and still have time left for themselves.

Everyone’s stretched thin.

It’s less about unwillingness to care for parents, and more about the sheer weight of modern life.

What Can We Do?

1. Start with Retirement Planning: Rule of 300 & Rule of 4%

These two simple rules give you a rough idea of your retirement needs.

Rule of 300

Your retirement corpus should be 300 times your monthly expense.

If you will spend ₹1,00,000 per month after retirement:

₹1,00,000 × 300 = ₹3 crore needed for retirement.

Rule of 4%

You can safely withdraw 4% of your corpus in your first retirement year,

and then increase that amount every year by inflation.

Example:

4% of ₹3 crore = ₹12 lakh a year = ₹1 lakh a month.

If inflation is 5%, then next year you withdraw:

₹12.6 lakh,

then ₹13.23 lakh,

then ₹13.89 lakh, and so on.

(Assuming retirement at age 60.)

2. Pay Yourself First

Robert Kiyosaki popularised this in Rich Dad Poor Dad.

The idea is simple:

Invest in your future first—manage expenses with what remains.

This helps you build assets over time.

But many people mistake liabilities for assets.

For example, buying a house often feels like an investment, but in India it usually comes with:

- heavy EMIs

- fluctuating interest rates

- maintenance

- repairs

- tenant issues

- and paperwork

And even after all that, real estate gives only about 6–8% returns, which is lower than many other investments.

Before buying a house, ask yourself:

- Is this truly an investment, or do I have better options?

- Do I see myself living in this city and this home for decades?

3. Don’t Lose Your Sense of Worth

Look at the Blue Zones—especially Okinawa, where many people live past 100.

They don’t retire in the traditional way; they keep contributing to their community.

They have a purpose—an Ikigai.

Many Indians feel lost after retirement because their identity was tied to their job.

Having hobbies, travel plans, or learning goals can give you a sense of direction.

Don’t wait for your kids to find time for you—create a life that excites you.

4. Build Your Own Community

In school and college, friendships come naturally.

At work, colleagues fill that space.

But post-retirement, you have to actively build a social circle.

Join group walks, fitness classes, hobby clubs, or travel groups.

A good community keeps you healthy, engaged, and emotionally fulfilled.

5. Start Early

We all know health is important—but most of us act too late.

Don’t wait for a health scare in your 50s or 60s.

Start in your 20s and 30s:

- Regular exercise (30 minutes a day is enough)

- Balanced diet

- Preventive check-ups

- Managing stress

- Sleeping well

Make health a non-negotiable part of daily life.

Conclusion

Old age brings challenges, but most of them can be managed with planning and proactive habits.

What many of us lack is long-term vision.

If we start saving early, take care of our health, build communities, and stay purposeful, our later years can be not just easier—but meaningful, fulfilling, and joyful.